The Best Strategy To Use For Estate Planning Attorney

The Best Strategy To Use For Estate Planning Attorney

Blog Article

An Unbiased View of Estate Planning Attorney

Table of ContentsHow Estate Planning Attorney can Save You Time, Stress, and Money.9 Easy Facts About Estate Planning Attorney ShownA Biased View of Estate Planning AttorneyNot known Incorrect Statements About Estate Planning Attorney 7 Simple Techniques For Estate Planning Attorney

A knowledgeable lawyer who comprehends all facets of estate preparation can help make certain customers' wishes are executed according to their purposes. With the ideal support from a reputable estate organizer, people can really feel confident that their plan has been produced with due care and attention to information. People require to spend ample time in locating the appropriate lawyer that can supply audio suggestions throughout the entire procedure of establishing an estate strategy.The records and directions produced during the planning process come to be legitimately binding upon the customer's fatality. A certified financial advisor, in accordance with the wishes of the deceased, will certainly after that begin to distribute trust assets according to the customer's guidelines. It is essential to keep in mind that for an estate plan to be efficient, it has to be properly implemented after the customer's death.

The appointed administrator or trustee should ensure that all properties are managed according to legal demands and according to the deceased's dreams. This usually involves accumulating all documentation pertaining to accounts, investments, tax obligation records, and various other items defined by the estate plan. Furthermore, the administrator or trustee may require to coordinate with lenders and beneficiaries associated with the distribution of possessions and various other matters referring to clearing up the estate.

In such situations, it may be necessary for a court to step in and resolve any type of problems before final circulations are made from an estate. Ultimately, all elements of an estate have to be worked out successfully and properly based on existing legislations to make sure that all parties included obtain their reasonable share as intended by their liked one's desires.

Not known Facts About Estate Planning Attorney

People require to plainly recognize all elements of their estate strategy prior to it is propelled (Estate Planning Attorney). Collaborating with a knowledgeable estate preparation attorney can help make certain the files are appropriately prepared, and all assumptions are met. Furthermore, an attorney can provide understanding right into just how different legal tools can be utilized to protect possessions and maximize the transfer of wealth from one generation to an additional

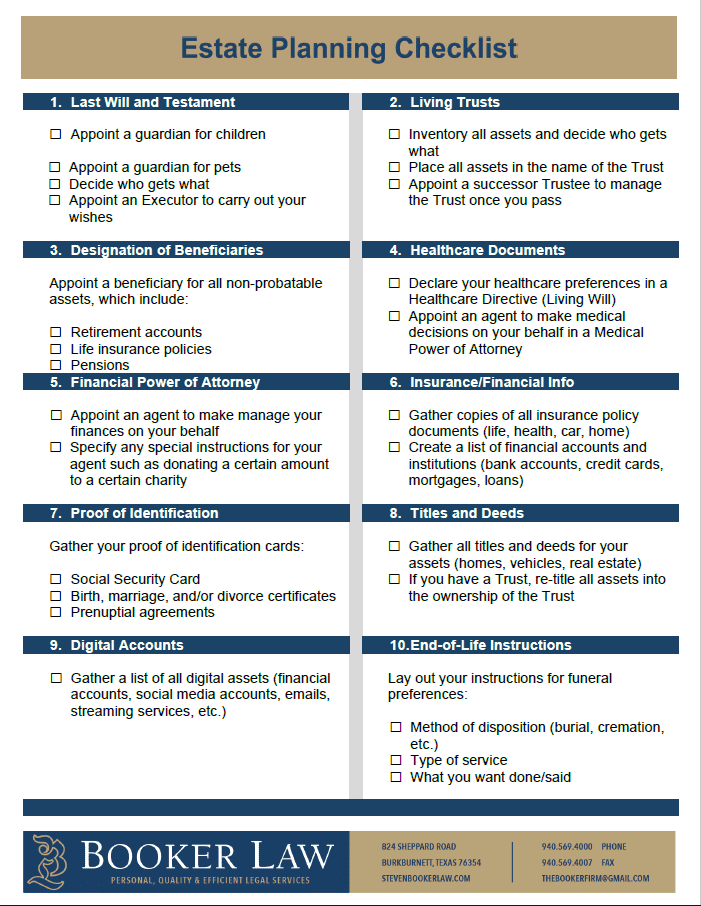

Estate intending describes the prep work of jobs that manage an individual's monetary scenario in the occasion of their incapacitation or fatality - Estate Planning Attorney. This preparation consists of the legacy of properties to successors and the negotiation of estate taxes and debts, in addition to other considerations like the guardianship of small kids and pet dogs

Several of the actions include noting possessions and debts, evaluating accounts, and writing a will. Estate intending jobs consist of making a will, establishing counts on, making charitable contributions to restrict inheritance tax, naming an administrator and recipients, and setting up funeral arrangements. A will offers guidelines concerning property and safekeeping of minor youngsters.

Some Known Factual Statements About Estate Planning Attorney

Estate planning can and ought to be utilized by everyonenot simply the ultra-wealthy., took care of, and distributed after death., pensions, financial obligation, and extra.

Anyone canand shouldconsider estate planning. There are different reasons you might start estate preparation, such as preserving family riches, offering an enduring partner and children, funding children's or grandchildren's education, and leaving your legacy for a charitable cause. Composing a will is among one of the most vital actions.

Testimonial your retired life accounts. This is vital, specifically for accounts that have actually recipients affixed to them. Bear in mind, any kind of accounts with a recipient pass straight to them. 5. Evaluation your insurance coverage and annuities. See to it your beneficiary information is up-to-date and all of your other details is accurate. 6. Establish joint accounts or transfer of death designations.

All about Estate Planning Attorney

8. Write your will. Wills do not simply unravel any monetary unpredictability, they can likewise set out plans for your minor children and pets, and you can also advise your estate to make philanthropic donations with the funds you leave behind. 9. Review your documents. Make certain you evaluate every little thing every number of years and make modifications whenever you choose.

Send out a copy of your will certainly click over here now to your administrator. Send out one to the person that will certainly assume obligation for your affairs after you pass away and keep an additional copy someplace risk-free.

Estate Planning Attorney - An Overview

There are tax-advantaged financial investment cars next page you can capitalize on to aid you and others, such as 529 university savings prepares for your grandchildren. A will certainly is a lawful document that offers guidelines about just how a person's residential property and custodianship of small youngsters (if any) ought to be managed after fatality.

Report this page